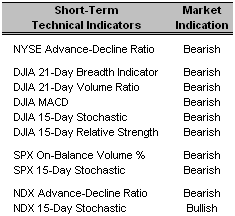

Bearish Indicators Abound

Long-Term Market Model – Bullish since August 23rd.

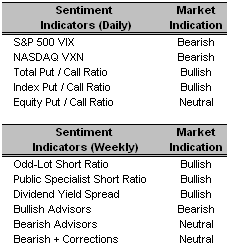

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX jumped nearly 15% yesterday with the CBOE Volatility Index for the S&P 500 closing over 24% higher than its 52-week low of 9.90, reached just last week.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Mid Cap Core (JKG 11/6/06)

Top Rated Sector Derivative – iShares U.S. Basic Materials (IYM 10/16/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- Alleghany Technologies Inc. (ATI 10/5/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- Emmis Communications Corp. (EMMS 11/20/06)

- Hansen Natural Corp. (HANS 8/4/06)

- Red Robin Gourmet Burgers, Inc. (RRGB 11/2/06)

- The Washington Post Co. (WPO 7/5/06)

0 Comments:

Post a Comment

<< Home