Change in Routine

I’ll add a short post-tomorrow, but nothing on Thursday and Friday due to the holiday. Have a Happy Thanksgiving and I’ll see you next Monday morning!

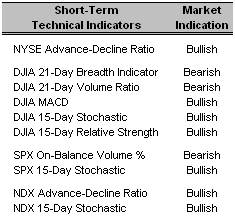

Short-Term Technical Indicators – Improvement in the DJIA 21-Day Breadth and Volume indicators on Monday was off-set by weakness in the 15-Day Stochastic and Relative Strength indicators.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX closed below 10 (9.97) on Monday for the first time since January 1994, suggesting institutional complacency despite an over-extended market.

Continuing with yesterday’s post, there is a clear dichotomy between our sentiment indicators which are “opinion” based and those that are more quantitative. Most investment surveys, which are designed as contrarian indicators, have bearish readings because of the large percentage of bullish sentiment. Indicators such as these fall into the “opinion-based” category.

But when you look at quantitative indicators such as the Odd-Lot Short Ratio, the Public Specialist Short Ratio, and the Dividend Yield Spread, they all have bullish readings. Indicators such as these, and a few others, carry more weight in our analysis when trying to gauge sentiment.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Date = Date of AAS “Buy” or "Short/Sell" Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones U.S. Real Estate (IYR 11/14/06)

Today’s Top “Buy” Recommended Stocks

- Daktronics Inc. (DAKT 10/31/06)

- Phelps Dodge Corp. (PD 11/20/06)

- RTI International Metals Inc. (RTI 10/11/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- Hansen Natural Corp. (HANS 8/4/06)

- Apollo Group Inc. (APOL 10/13/06)

- Bausch & Lomb Inc. (BOL 11/8/06)

- The Washington Post Co. (WPO 7/5/06)

0 Comments:

Post a Comment

<< Home