Is there alpha left in Retail?

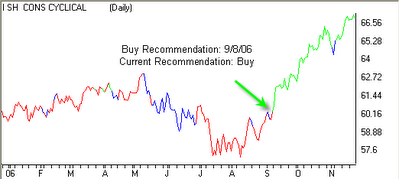

We use the iShares Dow Jones U.S. Consumer Services Sector ETF (IYC Buy 9/8/06) to represent “retail” in our sector analysis. After a choppy summer, IYC began to trend in late-August fueled by back-to-school and early-bird Christmas shoppers, as well as a mammoth slide in crude prices. Despite a moderate retreat in late-October, the trend has remained bullish and the derivative is up nearly 11% since the date of our “buy” recommendation.

Of the 134 “retail” stocks we analyze for alpha, 37 are “buy” recommended this morning. With less than 28% of the retail stocks “buy” recommended, I am concerned that over-weighting a portfolio with retail securities might be a bit dangerous at this point.

Of the 134 “retail” stocks we analyze for alpha, 37 are “buy” recommended this morning. With less than 28% of the retail stocks “buy” recommended, I am concerned that over-weighting a portfolio with retail securities might be a bit dangerous at this point.That’s not to say that the sector should be avoided, as there are still plenty of opportunities for alpha in retail. Nintendo, Microsoft and Sony are getting all of the attention with regard to video games, but GameStop Corp. (GME.B Buy 9/5/06), a retailer of video game products and personal computers, is our highest-rated retail company.

Another retail stock worth looking at is AutoZone Inc. (AZO Buy 9/11/06). I’ve listed AZO sporadically in the Top Buy Recommended Stocks section of my blog posts over the last few weeks.

Another retail stock worth looking at is AutoZone Inc. (AZO Buy 9/11/06). I’ve listed AZO sporadically in the Top Buy Recommended Stocks section of my blog posts over the last few weeks. A huge winner over the last week is PayLess Shoe Source (PSS Buy 10/26/06). PSS is up nearly 13% after reporting solid Q3 earnings.

A huge winner over the last week is PayLess Shoe Source (PSS Buy 10/26/06). PSS is up nearly 13% after reporting solid Q3 earnings. Finally, two retail stocks I find very interesting are Aaron Rents Inc. (RNT Buy 10/27/06) and Tech Data Corp. (TECD Buy 10/5/06). I like these not only because they’re outside of the “Apparel and Shoes” realm, which I’m a bit uneasy about at the moment, but they’re also trading below recent highs.

Finally, two retail stocks I find very interesting are Aaron Rents Inc. (RNT Buy 10/27/06) and Tech Data Corp. (TECD Buy 10/5/06). I like these not only because they’re outside of the “Apparel and Shoes” realm, which I’m a bit uneasy about at the moment, but they’re also trading below recent highs.

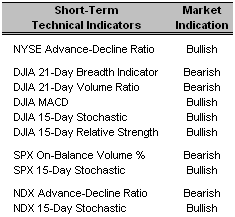

Short-Term Technical Indicators – The indicators for all three indexes weakened on Friday’s less than stellar session. Volume and Breadth continue to cause concern with regard to the Dow. It also looks as though the MACD is close to crossing below its 9-Day MA, which is another bearish indication. I’m most concerned about the Relative Strength indicator, which declined by over 17% on Friday. All three Stochastic indicators are bullish, but are weakening.

Short-Term Technical Indicators – The indicators for all three indexes weakened on Friday’s less than stellar session. Volume and Breadth continue to cause concern with regard to the Dow. It also looks as though the MACD is close to crossing below its 9-Day MA, which is another bearish indication. I’m most concerned about the Relative Strength indicator, which declined by over 17% on Friday. All three Stochastic indicators are bullish, but are weakening. Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – After jumping higher by nearly 2.5% on Wednesday, the VIX edged up again on Friday by nearly 6% to close at 10.73. This, coupled with an increase in the Put/Call ratio, indicates elevated speculation of a lower moving market.

Of the eleven Investor Sentiment indicators I analyze, six are bullish, three are bearish and two are neutral this morning. Bearish indicators include the % of Bullish Investment Advisors, the VIX, and the Long/Short Commercial Hedges of the S&P 500.

Conversely, the Odd-Lot Short Ratio, the NYSE Short Interest Ratio, the NASDAQ Short Interest Ratio, the Public Specialist Short Ratio, the Put/Call Ratio and the Dividend Yield Spread are all bullish.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares NASDAQ Biotechnology (IBB 10/6/06)

Today’s Top “Buy” Recommended Stocks

- Daktronics Inc. (DAKT 10/31/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Alleghany Technologies Inc. (ATI 10/5/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- Cyberonics Inc. (CYBX 11/14/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Harman International Industries Inc. (HAR 10/9/06)

- Manitowoc Co. Inc. (MTW 8/14/06)

- Volt Information Services Inc. (VOL 11/6/06)

0 Comments:

Post a Comment

<< Home