Happy Thanksgiving!

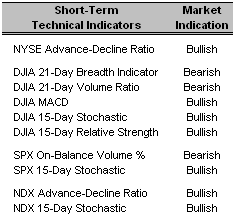

Short-Term Technical Indicators – The DJIA 21-Day Volume Ratio and 15-Day Stochastic as well as the S&P 500 On-Balance Volume % slipped slightly yesterday, while the DJIA 21-Day Breadth, MACD and 15-Day Relative Strength indicators improved.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX closed at 9.90 yesterday, another consecutive 52-week low. The VXN also closed lower at 15.02, but it remains well above its 52-week low of 13.19. All three Put/Call ratios edged higher, indicating that investors are speculating the market will move lower.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Date = Date of AAS “Buy” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Composite (ONEQ 8/30/06)

Top Rated Style-Box Derivative – iShares Morningstar Small Cap Core (JKJ 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones U.S. Real Estate (IYR 11/14/06)

Today’s Top “Buy” Recommended Stocks

- Daktronics Inc. (DAKT 10/31/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Alleghany Technologies Inc. (ATI 10/5/06)

- Phelps Dodge Corp. (PD 11/20/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- Whole Foods Market Inc. (WFMI 11/2/2006)

- Hansen Natural Corp. (HANS 8/4/06)

- Red Robin Gourmet Burgers, Inc. (RRGB 11/2/06)

- The Washington Post Co. (WPO 7/5/06)

- Humana Inc. (HUM 10/30/06)

0 Comments:

Post a Comment

<< Home