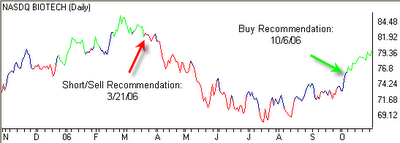

Biotech Revisited

For those of you who don’t know, the green line represents a “buy” recommendation, the red line represents a “short/sell” recommendation and the blue line represents a “neutral” recommendation.

Of the twelve biomed/genetics companies we analyze, six are “buy” recommended, while the other six are split between “neutral” and “sell” recommendations. Three of the “buy” recommended securities I’m watching closely are Medimmune Inc. (MEDI 10/27/06), PDL BioPharma Inc. (PDLI 10/6/06) and Amgen Inc. (AMGN 10/20/06).

Of the twelve biomed/genetics companies we analyze, six are “buy” recommended, while the other six are split between “neutral” and “sell” recommendations. Three of the “buy” recommended securities I’m watching closely are Medimmune Inc. (MEDI 10/27/06), PDL BioPharma Inc. (PDLI 10/6/06) and Amgen Inc. (AMGN 10/20/06).

Short-Term Technical Indicators – One of the data vendors we use is having problems this morning, so I’m unable to update my short-term technical indicators.

Short-Term Technical Indicators – One of the data vendors we use is having problems this morning, so I’m unable to update my short-term technical indicators.Long-Term Market Model – Bullish since August 23rd.

Investor Sentiment – The percentage of bullish advisors has edged higher again this week and is now only a shade away from the 55% level. Percentages of bullish advisors at that level often coincide with market tops, which can be viewed as a bearish indication. VIX and VXN both traded lower yesterday but remain above last week’s levels.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall investment portfolio.

Date = Date of AAS “Buy” Recommendation

Top Rated Major Market Derivative – Fidelity NASDAQ Comp. Index (ONEQ 8/30/06)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ 10/9/06)

Top Rated Sector Derivative – iShares Dow Jones Real Estate (IYR 6/30/06)

Today’s Top “Buy” Recommended Stocks

- OM Group Inc. (OMG 8/11/06)

- Allegheny Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Harman International Industries Inc. (HAR 10/9/06)

- Manitowoc Co. Inc (MTW 8/10/06)

- Goldman Sachs Group Inc. (GS 9/12/06)

- Veritas DGC Inc. (VTS 7/28/06)

- F5 Networks Inc. (FFIV9/20/06)

- Sears Holdings Corp. (SHLD 9/19/06)

- Piper Jaffray Companies (PJC 10/4/2006)

- Apollo Group Inc. (APOL 10/13/06)

- Carbo Ceramics Inc. (CRR 2/7/06)

- Express Scripts Inc. (ESRX 9/22/06)

- Legg Mason Inc. (LM 10/11/06)

- Omnicare Inc. (OCR 5/10/06)

0 Comments:

Post a Comment

<< Home