Retail Revisited

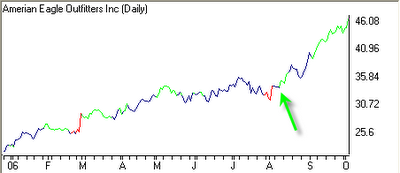

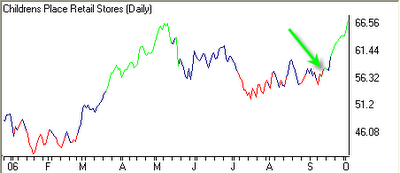

I mentioned Retail way back on August 11th as an alpha-producing sector. The analytics selected AEOS as a “buy” recommended stock two days earlier and I noticed a growing number of “buy” recommended companies within the sector. The point I’m trying to make is that with housing, inflation and consumer spending at the forefront of discussion back in August, who would have thought that retail stocks would have done so well? Generating alpha often times means investing against the grain and not letting the talking heads spook you. Trust the analytics, even if you don’t understand them at the time.

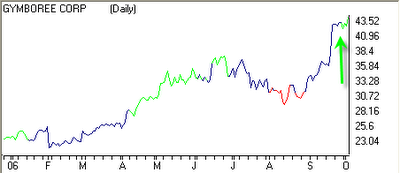

The green arrow represents the date of the "buy" recommendation. For whatever reason, the technical indicators were slow to confirm a "buy" for GYMB. That's just the way it goes.

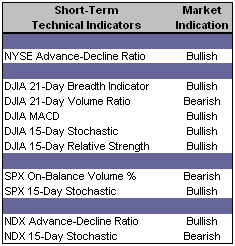

Short-Term Technical Indicators – There was improvement in the DJIA 21-Day Breadth and the NASDAQ Advance / Decline ratio overnight. Despite solid volume yesterday, the DJIA 21-Day Volume Ratio is still not at a point where it supports new highs.

Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX and VXN as well as all three Put / Call ratios retreated modestly from Tuesday’s levels. Volatility on Wednesday was slightly above that of last week, which is to be expected based on the recent economic data, fluctuation of commodity prices and broad-market gains.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – NASDAQ 100 (QQQQ)

Top Rated Style-Box Derivative – Morningstar Large Cap Core (JKD)

Top Rated Sector Derivative – iShares Dow Jones U.S. Financial Services (IYG)

Today’s Top “Buy” Recommended Stocks

- OM Group Inc. (OMG)

- CPI Corp. (CPY)

- Gymboree Corp. (GYMB)

- Goldman Sachs Group Inc. (GS)

- American Eagle Outfitters Inc. (AEOS)

0 Comments:

Post a Comment

<< Home