New High Not Technically Supported

With the Dow breaking its record, attention now shifts to the other, and arguably more important, indexes. With the NASDAQ no where near its high, the S&P 500 pretty much takes the spotlight. Rod Smyth, Bill Ryder and Ken Liu from Wachovia Securities wrote another good piece on what to expect next with regards to the S&P 500. They argue that the short-term risk/reward for stocks is not favorable to investors and that patience is recommended until after the correction.

With the Dow breaking its record, attention now shifts to the other, and arguably more important, indexes. With the NASDAQ no where near its high, the S&P 500 pretty much takes the spotlight. Rod Smyth, Bill Ryder and Ken Liu from Wachovia Securities wrote another good piece on what to expect next with regards to the S&P 500. They argue that the short-term risk/reward for stocks is not favorable to investors and that patience is recommended until after the correction.They also delve into what to expect from the S&P 500 with regards to its 6% channel over the next few months. I’ve attached their “Chart of the Week” below. They’re expecting the S&P to trade much like it did for the first half of 2006, near the top of its channel.

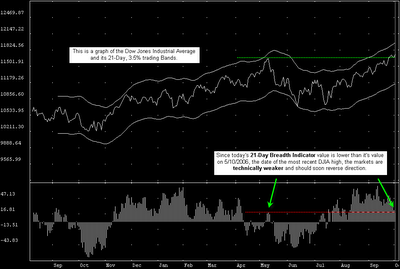

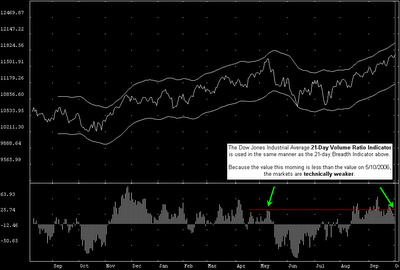

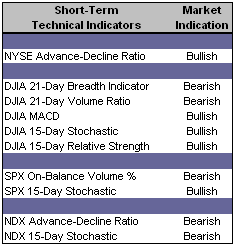

Short-Term Technical Indicators – We’ve got a mixed bag this morning, with the only consistent reading coming from the weakness of the NASDAQ.

Short-Term Technical Indicators – We’ve got a mixed bag this morning, with the only consistent reading coming from the weakness of the NASDAQ. Long-Term Market Model – Bullish since August 23rd.

Long-Term Market Model – Bullish since August 23rd.Investor Sentiment – The VIX and Index Put / Call ratio slipped a bit while the VXN, Equity and Total Put / Call ratios gained. Volatility, for the most part, is higher than last week but still within a normal range. We’re seeing an increase in bullish sentiment across several polls and surveys. Typically, this does not bode well for stocks.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Dow Jones Industrials Diamond Trust (DIA)

Top Rated Style-Box Derivative – Morningstar Large Cap Core (JKD)

Top Rated Sector Derivative – iShares Dow Jones U.S. Financial Services (IYG)

Today’s Top “Buy” Recommended Stocks

- CPI Corp. (CPY)

- OM Group Inc. (OMG)

- Gymboree Corp. (GYMB)

- Goldman Sachs Group Inc. (GS)

- American Eagle Outfitters Inc. (AEOS)

0 Comments:

Post a Comment

<< Home