Good Morning

Long-Term Market Model – Bearish since December 8th.

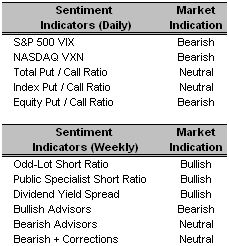

Long-Term Market Model – Bearish since December 8th.Investor Sentiment – Another substantial reduction in VIX and VXN coupled with a decrease in number of Equity and Total puts. However, the Index Put / Call ratio edged higher.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – NYSE 100 (NYC 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Large Cap Value (JKF 11/29/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Alleghany Technologies Inc. (ATI 10/5/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Daktronics Inc. (DAKT 10/31/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- Robbins & Myers Inc. (RBN 8/10/06)

- The Ryland Group Inc. (RYL 11/14/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Albemarle Corp. (ALB 8/9/06)

- Century Aluminum Co. (CENX 11/20/06)

0 Comments:

Post a Comment

<< Home