Good Morning

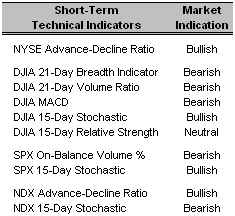

The correlation between these technical indicators and the performance of the market has become un-glued over the last few weeks. Despite bearish and overbought indications manifesting themselves quite awhile ago, the market continues to climb. Nevertheless, as the market sorts out the last remaining issues of the year, expect these indicators to continue to fluctuate.

Long-Term Market Model – Bearish since December 8th.

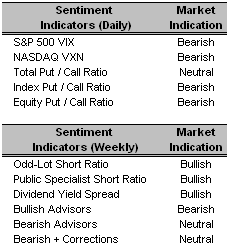

Long-Term Market Model – Bearish since December 8th.Investor Sentiment – Predicating the FOMC meeting today was an 11.27% drop in the VIX and a 9.32% drop in the VXN. In addition, the Index Put / Call ratio, with a reading of 1.15, is now bearish.

One of the things I’ve been working on of late is trying to establish “new” rules for interpreting the VIX and certain put / call ratios. Dr. Brett has engaged in a similar feat, although his research appears well ahead of mine at this point. Historically speaking, VIX values below 20 are supposed to illustrate complacency in the market, a short-term bearish indication. But with only three days of VIX values above 20 all year (6/12/06 through 6/14/06), and none even remotely near the 29 point level required for a historic bullish reading, the VIX formula needs an update. My thoughts so far involve combining ratios between the 52-week highs and lows of the VIX with volume, but I need to iron it out a bit.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Date = Date of AAS “Buy” or “Short/Sell” Recommendation

Top Rated Major Market Derivative – iShares Russell 2000 (IWM 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Mid Cap Core (JKG 11/6/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- Alleghany Technologies Inc. (ATI 10/5/06)

- RTI International Metals Inc. (RTI 10/11/06)

- Veritas DGC Inc. (VTS 7/28/06)

- Daktronics Inc. (DAKT 10/31/06)

- Chaparral Steel Co. (CHAP 11/1/06)

- Manitowoc Company Inc. (MTW 8/10/06)

- Robbins & Myers Inc. (RBN 8/10/06)

- Albemarle Corp. (ALB 8/9/06)

- Credence Systems Corp. (CMOS 11/6/06)

- F5 Networks Inc. (FFIV 9/20/06)

3 Comments:

Justin, I'm from Charlotte as well. Good to know there is another highly intelligent trader out there on the east coast! Heh. Let's Link up!

Thanks,

-Cal

By Anonymous, at 11:38 AM

Anonymous, at 11:38 AM

Hey Justin:

There are short-term VIX rules out there (like if it gets 10% below the 10 Day SMA, it's a short term sell in the market, et. al.).

What I would be careful of is a Rule that says "VIX below X-Value" is market sell, stuff like that. "Fair Value" of the VIX (if there is such a thing) has gotten lower over the course of time thanks to liquidity, automation, yada yada. So a VIX of 20 in today's world is extreme Fear, stuff like that.

By Adam, at 1:07 PM

Adam, at 1:07 PM

You're exactly right, VIX rules like that are basically useless now. Hopefully I can spend some time on it and I'll let you know what I come up with.

By Justin, at 5:57 PM

Justin, at 5:57 PM

Post a Comment

<< Home