Bring on the Profit Taking

Fortunately, we made the decision to remain 100% long in the AAS Model Fund Portfolios. We sold one of the holdings in the Model Stock Portfolio yesterday, and instead of replacing it with another issues, moved the money to cash. So the Model Stock Portfolio is 96.57% long and 3.43% cash.

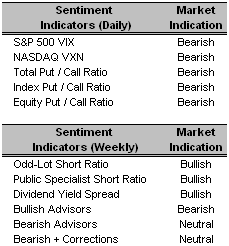

I continue to expect a moderate sell-off in between now and the end of the year. The impetus for the sell-off will probably be from profit taking as opposed to any fundamental weakness in the market. Today’s economic data bodes well for 2007, with inflation seemingly under control and economic growth moderate. The decision is whether to ride the rally through the end of the year or to take some profit off the table. Being bearish, I’m leaning towards reducing the allocation of the model portfolios and taking some profit. I might even consider a small percentage in inverse index funds, but I’ll wait until next week before seriously considering it.

Short-Term Technical Indicators – We finally got broad-based improvement in the Short-Term Technical indicators yesterday with all but one, the DJIA 21-Day Breadth Indicator, improving. The MACD crossed back over its 9-Day MA, which is a short-term bullish signal.

Long-Term Market Model – Bearish since December 8th.

Long-Term Market Model – Bearish since December 8th.Investor Sentiment – The VIX and VXN closed yesterday over 20% lower than their respective closing prices last Thursday.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.

Asset Allocation – 100% invested within the actively-managed, alpha producing portion of the overall portable alpha portfolio.Top Rated Major Market Derivative – NYSE 100 (NYC 11/6/06)

Top Rated Style-Box Derivative – iShares Morningstar Large Cap Value (JKF 11/29/06)

Top Rated Sector Derivative – iShares Dow Jones Energy (IYE 11/10/06)

Today’s Top “Buy” Recommended Stocks

- RTI International Metals Inc. (RTI 10/11/06)

- Daktronics Inc. (DAKT 10/31/06)

- Alleghany Technologies Inc. (ATI 10/5/06)

- Veritas DGC Inc. (VTS 7/28/06)

- F5 Networks Inc. (FFIV 9/20/06)

- Robbins & Myers Inc. (RBN 8/10/06)

- Albemarle Corp. (ALB 8/9/06)

- Manitowoc Company Inc. (MTW 8/10/06)

- Credence Systems Corp. (CMOS 11/6/06)

- NBTY, Inc. (NTY 12/5/06)

0 Comments:

Post a Comment

<< Home