Bears Getting Louder

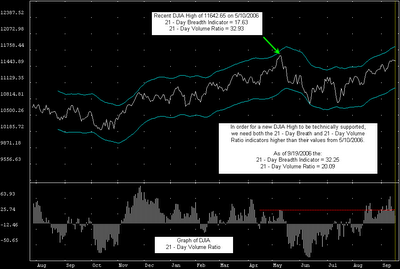

Short-Term Technical Indicators – On Monday I highlighted the 21 – Day Breadth Indicator as a technical analytic that would support a new DJIA high. That indicator, although continuing to slip, is still in a position to support such a move.

Another analytic I use is the 21 – Day Volume Ratio, which is also designed to support a new high. Due to the volatility experienced over the last few days, this value currently does not support a new DJIA high. However, it’s entirely possible that if we were to see a new high today or later this week, the stimulus used to generate the new high would be enough to push the 21 – Day Volume ratio higher into a supporting position.

Long-Term Market Model – Bullish since August 23rd.

Investor Sentiment – There was dramatic movement in all three Put / Call ratios yesterday, but the Index Put / Call ratio jumped by more than 50%. The current value is now only 0.73 away from its 52-week high of 3.89. Since mid-October of 2003, the Index Put / Call Ratio has crossed above the 3.0 threshold only eight times, with the previous two being 5/24/2006 and 9/26/2005. This elevated value is the result of a higher volume of Puts compared to Calls, which indicates bearish sentiment.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Russell 2000 (IWM)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ)

Top Rated Sector Derivative – iShares Dow Jones U.S. Real Estate (IYR)

Today’s Top “Buy” Recommended Stocks

- NVR Inc. (NVR)

- Piper Jaffray Companies (PJC)

- Veritas DGC Inc. (VTS)

- Sears Holding Corp. (SHLD)

- NCI Building Systems Inc. (NCS)

0 Comments:

Post a Comment

<< Home