Broad-Based Trend Developing

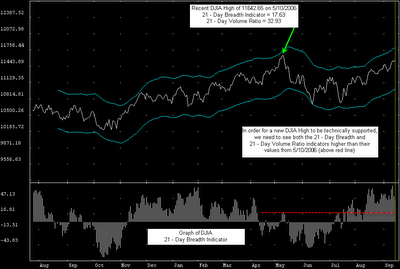

Short-Term Technical Indicators – Six of the eight strengthened after Friday’s close. With all of the talk this week about the potential for a new all-time high for the Dow Jones Industrial Average, I’m paying special attention to three indicators designed to support or refute new highs. Of those three, only one strengthened after Friday, the On-Balance Volume % indicator. However, despite both the 21-Day Breath and 21-Day Volume Ratio indicators slipping slightly, they are both in position, at least as of this morning, to support a new DJIA high.

Long-Term Market Model – Bullish since August 23rd.

Investor Sentiment – Market volatility jumped slightly on Friday, with both the VIX and VXN higher than Thursday’s values. There was also a modest increase in the Index Put / Call Ratio. However, all five sentiment indicators I use are much closer to their 52-Week low’s than they are to their respective highs. Sentiment is bullish throughout the market, with both private and professional investors expecting another solid week for stocks fueled by encouraging economic reports.

Asset Allocation – 75% to 85% invested within the actively-managed portion of the overall investment portfolio. 15% to 25% in cash or bonds.

Top Rated Major Market Derivative – Fidelity NASDAQ Composite Index (ONEQ)

Top Rated Style-Box Derivative – Morningstar Small Cap Core (JKJ)

Top Rated Sector Derivative – Dow Jones iShares Real Estate (IYR)

Today’s Top “Buy” Recommended Stocks

0 Comments:

Post a Comment

<< Home