AAS Top Ten as of September 1, 2006

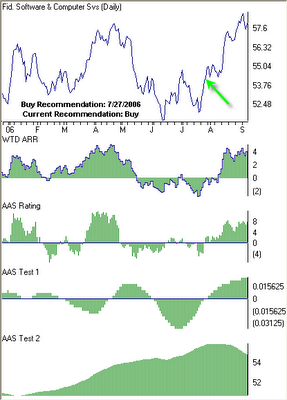

The green arrow represents the first date that the security became an “AAS Recommended Buy” after previously being an “AAS Recommended Sell.” For the “Short-Sale” group, the red arrow represents the first date that the security became an “AAS Recommended Sell” after previously being “buy” recommended. Also included are the most recent recommendations of each security.

Chaparral Steel Company (CHAP) was again our highest rated stock within the “Long Stock” group as of September 1, 2006. CHAP has been one of our highest rated companies for at least a month now, sharing the spot with CPY and ESRX. I noted in an earlier post that the stock had been range-bound for the last few weeks, hopefully emerging from it in the last week of August. The company took part in a 2:1 stock split on September 5th, which results in an adjustment of the prices that I quoted in earlier posts. Our analysis produced a “buy” recommendation on July 27, 2006 when the adjusted closing price was 34.94. As of Friday, September 8th, CHAP closed at 37.83 for a gain of 8.27% since the initial “buy” recommendation. Currently, the stock carries a “Buy” recommendation.

Hansen Natural Corp. (HANS) was our weakest stock within the “Short-Sell Stock” group. The first few days of August were hard on HANS, with the stock declining on fairly significant volume. Our analytics produced a “short-sell” recommendation on August 4th with a closing price of 40.25. As of September 8th, HANS closed at 27.46 for a gain of 31.78% since the initial short-sale recommendation. Shorting stocks, although profitable if done correctly, is risky business. There's no need to do it unless you have the experience, knowledge, and capital to cover your short if needed. QMA does not short stocks for its clients and AAS does not recommend the practice to its subscribers.

Hansen Natural Corp. (HANS) was our weakest stock within the “Short-Sell Stock” group. The first few days of August were hard on HANS, with the stock declining on fairly significant volume. Our analytics produced a “short-sell” recommendation on August 4th with a closing price of 40.25. As of September 8th, HANS closed at 27.46 for a gain of 31.78% since the initial short-sale recommendation. Shorting stocks, although profitable if done correctly, is risky business. There's no need to do it unless you have the experience, knowledge, and capital to cover your short if needed. QMA does not short stocks for its clients and AAS does not recommend the practice to its subscribers. The iShares S&P Latin America 40 Index ETF (ILF) was our highest rated within the “Exchange Traded Fund” group for the week ending September 1st, 2006. There were a significant number of “buy” recommended ETF’s at this point, but due to the volatility of late, especially with regard to international markets, the rating scores of most ETF’s were lower than normal. Generally, our top rated stocks and funds have rating scores of at least 50, but ILF had a rating score of only 19 on September 1st. In a previous post I noted that ILF was up-graded to an "AAS Recommended Buy" on August 2, 2006 when the closing price was 140.09. Since then, ILF has reversed from a “buy” status to a “sell” status several times, finally being downgraded to a recommended “sell” on September 7th when the closing price was 138.63. That equates to a loss of -1.04% since the initial “buy” recommendation on August 2nd. This is a solid fund, but too volatile now, even for active management. Investors wanting to invest in emerging markets or other international funds might want to wait for the markets abroad to stabilize a bit more.

The iShares S&P Latin America 40 Index ETF (ILF) was our highest rated within the “Exchange Traded Fund” group for the week ending September 1st, 2006. There were a significant number of “buy” recommended ETF’s at this point, but due to the volatility of late, especially with regard to international markets, the rating scores of most ETF’s were lower than normal. Generally, our top rated stocks and funds have rating scores of at least 50, but ILF had a rating score of only 19 on September 1st. In a previous post I noted that ILF was up-graded to an "AAS Recommended Buy" on August 2, 2006 when the closing price was 140.09. Since then, ILF has reversed from a “buy” status to a “sell” status several times, finally being downgraded to a recommended “sell” on September 7th when the closing price was 138.63. That equates to a loss of -1.04% since the initial “buy” recommendation on August 2nd. This is a solid fund, but too volatile now, even for active management. Investors wanting to invest in emerging markets or other international funds might want to wait for the markets abroad to stabilize a bit more. The Fidelity Select Software & Computer Fund (FSCSX) was again our highest rated within the “Fidelity Select Mutual Fund” group. FSCSX was last upgraded to an “AAS Recommended Buy” on July 27, 2006 when the closing price was 54.24. As of Friday, September 8th, FSCSX closed at 57.95 for a gain of 6.84% since the initial “buy” recommendation. Currently, FSCSX remains an “AAS Recommended Buy.”

The Fidelity Select Software & Computer Fund (FSCSX) was again our highest rated within the “Fidelity Select Mutual Fund” group. FSCSX was last upgraded to an “AAS Recommended Buy” on July 27, 2006 when the closing price was 54.24. As of Friday, September 8th, FSCSX closed at 57.95 for a gain of 6.84% since the initial “buy” recommendation. Currently, FSCSX remains an “AAS Recommended Buy.” The ProFunds Ultra Japan Fund (UJPIX) was again our highest rated within the “ProFund Mutual Fund” group for the fourth week in a row. This fund was last upgraded to an “AAS Recommended Buy” on August 9, 2006 when the closing price was 59.61. As of Friday, September 8th, UJPIX closed at 63.24 for a gain of 6.09%. Currently, UJPIX is an “AAS Recommended Buy.”

The ProFunds Ultra Japan Fund (UJPIX) was again our highest rated within the “ProFund Mutual Fund” group for the fourth week in a row. This fund was last upgraded to an “AAS Recommended Buy” on August 9, 2006 when the closing price was 59.61. As of Friday, September 8th, UJPIX closed at 63.24 for a gain of 6.09%. Currently, UJPIX is an “AAS Recommended Buy.”  The Rydex Precious Metals Fund (RYPMX) was again our highest rated within the “Rydex Mutual Fund” group for the second week in a row. This fund was last upgraded to an “AAS Recommended Buy” on August 31, 2006 when the closing price was 55.67. As of Friday, September 8tht, RYPMX closed at 54.19 for a loss of -2.66%. Currently, RYPMX remains an “AAS Recommended Neutral” mutual fund, although investors should continue to expect elevated volatility within precious metals.

The Rydex Precious Metals Fund (RYPMX) was again our highest rated within the “Rydex Mutual Fund” group for the second week in a row. This fund was last upgraded to an “AAS Recommended Buy” on August 31, 2006 when the closing price was 55.67. As of Friday, September 8tht, RYPMX closed at 54.19 for a loss of -2.66%. Currently, RYPMX remains an “AAS Recommended Neutral” mutual fund, although investors should continue to expect elevated volatility within precious metals.

0 Comments:

Post a Comment

<< Home