AAS Top Ten as of August 25, 2006

The graphs below represent the top holding within each of the six groups as of Friday, August 25, 2006. The green arrow represents the first date that the security became an “AAS Recommended Buy” after previously being an “AAS Recommended Sell.” I’ve also included the most recent recommendation of each security. All six securities are up since their initial “buy” recommendation. This serves to support our transition to “conservative bulls” occurring in the last week of August. We’re looking for another good week for stocks, benefiting from increased volume thanks to the return of institutional investors to Wall Street.

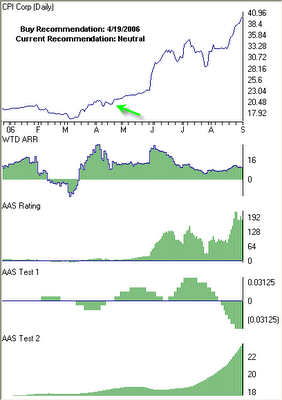

CPI Corp. (CPY) was our highest rated stock within the “Long Stock” group as of August 25th, 2006. This company manufactures and sells professional portrait equipment for the photography of babies, children, adults and families. It operates its 1,046 studios across the U.S., Canada and Puerto Rico under license agreements with Sears. Although CPY is included within the consumer services sector, a weakened market segment over the last few months, it can also be included within technology or software sectors, both of which have outperformed recently. Our analysis produced a “buy” recommendation way back on April 19, 2006 when the dividend-adjusted closing price was 27.44. As of Friday, September 1st, CPY closed at 40.06 for a gain of 45.99% since the initial “buy” recommendation. Currently, the stock carries a “neutral” status.

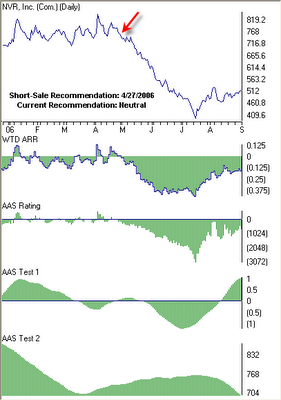

NVR, Inc. (NVR) was again our weakest stock within the “Short-Sell Stock” group. NVR was upgraded on April 25, 2006 to a “buy” recommended security, but then almost immediately reverted to a “sell” recommended security two days later when the closing price was 763.00. As of September 1st, NVR closed at 512.40 for a gain of 32.84% since the initial “short-sale” recommendation. NVR, Inc. operates in both the homebuilding and mortgage banking industries, which helps explain the poor performance over the last few months. The stock appears to have bottomed in mid-July and is currently trending upwards primarily on relatively good economic reports and the increased potential of a soft-landing. As a result of the recent improvement, NVR is now a recommended “neutral” security. Shorting stocks, although profitable if done correctly, is risky business. There's no need to do it unless you have the experience, knowledge, and capital to cover your short if needed. QMA does not short stocks for its clients and AAS does not recommend the practice to its subscribers.

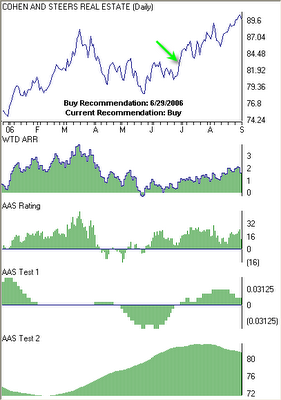

NVR, Inc. (NVR) was again our weakest stock within the “Short-Sell Stock” group. NVR was upgraded on April 25, 2006 to a “buy” recommended security, but then almost immediately reverted to a “sell” recommended security two days later when the closing price was 763.00. As of September 1st, NVR closed at 512.40 for a gain of 32.84% since the initial “short-sale” recommendation. NVR, Inc. operates in both the homebuilding and mortgage banking industries, which helps explain the poor performance over the last few months. The stock appears to have bottomed in mid-July and is currently trending upwards primarily on relatively good economic reports and the increased potential of a soft-landing. As a result of the recent improvement, NVR is now a recommended “neutral” security. Shorting stocks, although profitable if done correctly, is risky business. There's no need to do it unless you have the experience, knowledge, and capital to cover your short if needed. QMA does not short stocks for its clients and AAS does not recommend the practice to its subscribers. The iShares Cohen & Steers Realty Majors ETF (ICF) was our highest rated within the “Exchange Traded Fund” group. The fund seeks investment results that correspond to the price and yield performance of the Cohen & Steers Realty Majors Index, which consists of selected Real Estate Investment Trusts. I pointed out how REIT’s were generating alpha both in mid-July as well as late-August and still view Real Estate (IYR) as a highly-rated sector. ICF was last up-graded to an "AAS Recommended Buy" on June 29, 2006 when the closing price was 82.96. As of Friday, September 1st, ICF closed at 89.91 for a gain of 8.37% since the initial “buy” recommendation. Currently, ICF remains an “AAS Recommended Buy.”

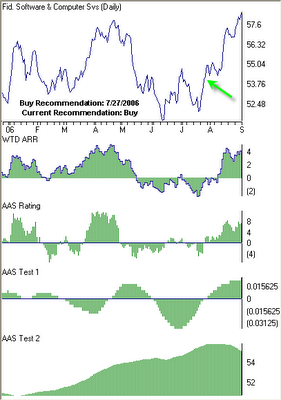

The iShares Cohen & Steers Realty Majors ETF (ICF) was our highest rated within the “Exchange Traded Fund” group. The fund seeks investment results that correspond to the price and yield performance of the Cohen & Steers Realty Majors Index, which consists of selected Real Estate Investment Trusts. I pointed out how REIT’s were generating alpha both in mid-July as well as late-August and still view Real Estate (IYR) as a highly-rated sector. ICF was last up-graded to an "AAS Recommended Buy" on June 29, 2006 when the closing price was 82.96. As of Friday, September 1st, ICF closed at 89.91 for a gain of 8.37% since the initial “buy” recommendation. Currently, ICF remains an “AAS Recommended Buy.” The Fidelity Select Software & Computer Fund (FSCSX) was again our highest rated within the “Fidelity Select Mutual Fund” group. The fund normally invests 80% of assets in companies that design, produce or distribute software products. The software sector, as represented by IGV, gained over 1.70% last week, is up nearly 6% over the last month, and remains an AAS Recommended “Buy” sector. FSCSX was last upgraded to an “AAS Recommended Buy” on July 27, 2006 when the closing price was 54.24. As of Friday, September 1st, FSCSX closed at 58.36 for a gain of 7.60% since the initial “buy” recommendation. Currently, FSCSX remains an “AAS Recommended Buy.”

The Fidelity Select Software & Computer Fund (FSCSX) was again our highest rated within the “Fidelity Select Mutual Fund” group. The fund normally invests 80% of assets in companies that design, produce or distribute software products. The software sector, as represented by IGV, gained over 1.70% last week, is up nearly 6% over the last month, and remains an AAS Recommended “Buy” sector. FSCSX was last upgraded to an “AAS Recommended Buy” on July 27, 2006 when the closing price was 54.24. As of Friday, September 1st, FSCSX closed at 58.36 for a gain of 7.60% since the initial “buy” recommendation. Currently, FSCSX remains an “AAS Recommended Buy.” The ProFunds Ultra Japan Fund (UJPIX) was again our highest rated within the “ProFund Mutual Fund” group for the third week in a row. This fund, which is leveraged to correspond to 200% of the daily performance of the Nikkei 225 Stock Average, was last upgraded to an “AAS Recommended Buy” on August 9, 2006 when the closing price was 59.61. As of Friday, September 1st, UJPIX closed at 64.51 for a gain of 8.22%. Currently, UJPIX is an “AAS Recommended Buy.”

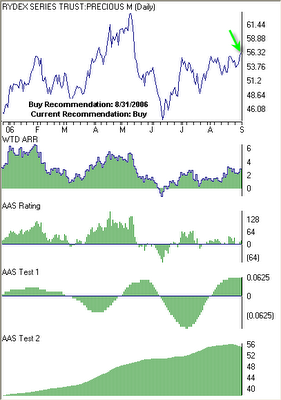

The ProFunds Ultra Japan Fund (UJPIX) was again our highest rated within the “ProFund Mutual Fund” group for the third week in a row. This fund, which is leveraged to correspond to 200% of the daily performance of the Nikkei 225 Stock Average, was last upgraded to an “AAS Recommended Buy” on August 9, 2006 when the closing price was 59.61. As of Friday, September 1st, UJPIX closed at 64.51 for a gain of 8.22%. Currently, UJPIX is an “AAS Recommended Buy.” The Rydex Precious Metals Fund (RYPMX) was our highest rated within the “Rydex Mutual Fund” group on August 25th. This mutual fund, more so than any of the other five securities listed above, has been extremely volatile over the last few weeks, shifting from “buy” to “sell” status several times. RYPMX seeks investment results that correspond to those of the XAU index and was last upgraded to an “AAS Recommended Buy” on August 31, 2006 when the closing price was 55.67. As of Friday, September 1st, RYPMX closed at 56.28 for a gain of 1.10%. Currently, RYPMX remains an “AAS Recommended Buy” mutual fund, although investors should continue to expect elevated volatility within precious metals.

The Rydex Precious Metals Fund (RYPMX) was our highest rated within the “Rydex Mutual Fund” group on August 25th. This mutual fund, more so than any of the other five securities listed above, has been extremely volatile over the last few weeks, shifting from “buy” to “sell” status several times. RYPMX seeks investment results that correspond to those of the XAU index and was last upgraded to an “AAS Recommended Buy” on August 31, 2006 when the closing price was 55.67. As of Friday, September 1st, RYPMX closed at 56.28 for a gain of 1.10%. Currently, RYPMX remains an “AAS Recommended Buy” mutual fund, although investors should continue to expect elevated volatility within precious metals.

0 Comments:

Post a Comment

<< Home