AAS Top Ten as of August 4, 2006

The graphs below represent the top holding within each of the six groups as of Friday, August 4, 2006. In highly volatile range-bound markets, our analytics vacillate between “Buy” and “Neutral” as well as “Sell” and “Neutral.” Remember that a “neutral” rating, in our analysis, means the same thing as a “hold.”

As such, the green arrow represents the first date that the security became an “AAS Recommended Buy” after previously being an “AAS Recommended Sell.” I’ve also included the most recent recommendation of each security. You’ll notice that the performance this week is lackluster compared to previous “AAS Top Ten” posts. Of the six equities listed below, three were gainers and three were losers. I’m certainly not happy about this, but it’s to be expected when the markets are this volatile. Let’s hope things begin to calm down this week!

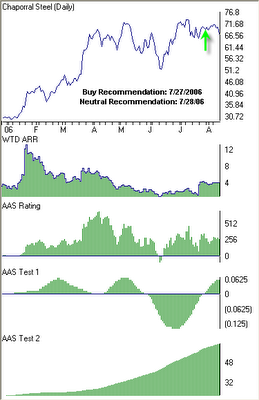

Chaporral Steel Company (CHAP) was our highest rated stock within the “Long Stock” group as of August 4, 2006. This stock does a great job of illustrating the elevated volatility lately and how it can impact a quantitative investment approach. CHAP shifted from a “neutral” recommendation on July 26, 2006 to a “buy” recommendation on July 27, 2006 when the closing price was 69.88. The very next day, it shifted back to a “neutral” recommendation, where it remains as of August 11, 2006. The closing price on Friday was 67.00, which results in a loss of 4.12% since the “buy” recommendation.

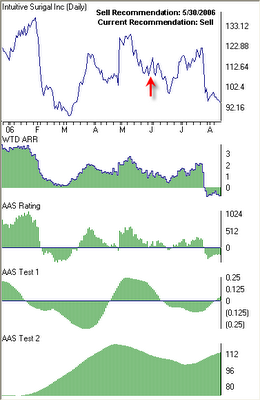

Intuitive Surgical Inc. (ISRG) was our lowest rated stock within the “Short-Sell Stock” group as of August 4, 2006. This company further exemplifies the volatility investors have battled over the last few weeks. ISRG shifted to a “sell” recommendation on May 30, 3006 when the price was 107.94. As you can tell from the graph, ISRG continued to move south, only to re-coup the losses in June and July, and then lose more from late-July into August. Throughout all of this, ISRG remained either “neutral” or “sell” recommended. As of Friday, August 11th, ISRG closed at 94.40 for a loss of 12.54% since May 30th. Shorting stocks, although profitable if done correctly, is risky business. There's no need to do it unless you have the experience, knowledge, and capital to cover your short if needed. QMA does not short stocks for its clients and AAS does not recommend the practice to its subscribers.

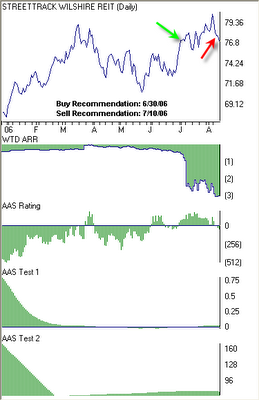

Intuitive Surgical Inc. (ISRG) was our lowest rated stock within the “Short-Sell Stock” group as of August 4, 2006. This company further exemplifies the volatility investors have battled over the last few weeks. ISRG shifted to a “sell” recommendation on May 30, 3006 when the price was 107.94. As you can tell from the graph, ISRG continued to move south, only to re-coup the losses in June and July, and then lose more from late-July into August. Throughout all of this, ISRG remained either “neutral” or “sell” recommended. As of Friday, August 11th, ISRG closed at 94.40 for a loss of 12.54% since May 30th. Shorting stocks, although profitable if done correctly, is risky business. There's no need to do it unless you have the experience, knowledge, and capital to cover your short if needed. QMA does not short stocks for its clients and AAS does not recommend the practice to its subscribers. The streetTRACKS Wilshire REIT ETF (RWR) was our highest rated within the “Exchange Traded Fund” group. It was last up-graded from an “AAS Recommended Neutral” to an "AAS Recommended Buy" on June 30, 2006 when the closing price was 75.98. However, RWR deteriorated rapidly and became an AAS Recommended Sell” on August 10th with a closing price of 77.61. The gain from being a recommended “buy” to a recommended “sell” was 2.14%. Currently, RWR remains an "AAS Recommended Sell."

The streetTRACKS Wilshire REIT ETF (RWR) was our highest rated within the “Exchange Traded Fund” group. It was last up-graded from an “AAS Recommended Neutral” to an "AAS Recommended Buy" on June 30, 2006 when the closing price was 75.98. However, RWR deteriorated rapidly and became an AAS Recommended Sell” on August 10th with a closing price of 77.61. The gain from being a recommended “buy” to a recommended “sell” was 2.14%. Currently, RWR remains an "AAS Recommended Sell." The Fidelity Select Utilities Growth Fund (FSUTX) was our highest rated within the “Fidelity Select Mutual Fund” group. It was last upgraded from an “AAS Recommended Neutral” to an “AAS Recommended Buy” on June 28, 2006 when the closing price was 46.87. As of Friday, August 11th, FSUTX closed at 49.20 for a gain of 4.97% since the initial investment. Currently, FSUTX remains an “AAS Recommended Buy.”

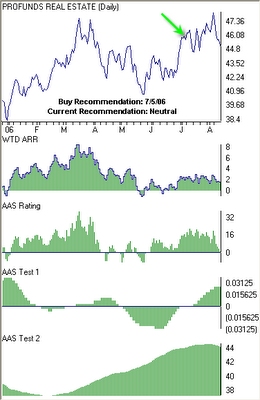

The Fidelity Select Utilities Growth Fund (FSUTX) was our highest rated within the “Fidelity Select Mutual Fund” group. It was last upgraded from an “AAS Recommended Neutral” to an “AAS Recommended Buy” on June 28, 2006 when the closing price was 46.87. As of Friday, August 11th, FSUTX closed at 49.20 for a gain of 4.97% since the initial investment. Currently, FSUTX remains an “AAS Recommended Buy.” The ProFunds Ultra Real Estate Investment Fund (REPIX) was our highest rated within the “ProFund Mutual Fund” group for the second week in a row. This fund is leveraged to correspond to 150% of the daily performance of the Dow Jones U.S. Real Estate Index. This mutual fund was last upgraded from an “AAS Recommended Neutral” to an “AAS Recommended Buy” on July 5, 2006 when the closing price was 45.76. As of Friday, August 11th, REPIX closed at 45.05 for a loss of -1.55%. Currently, REPIX is an “AAS Recommended Neutral.”

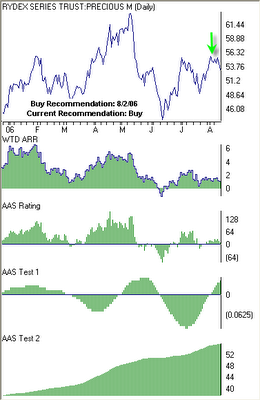

The ProFunds Ultra Real Estate Investment Fund (REPIX) was our highest rated within the “ProFund Mutual Fund” group for the second week in a row. This fund is leveraged to correspond to 150% of the daily performance of the Dow Jones U.S. Real Estate Index. This mutual fund was last upgraded from an “AAS Recommended Neutral” to an “AAS Recommended Buy” on July 5, 2006 when the closing price was 45.76. As of Friday, August 11th, REPIX closed at 45.05 for a loss of -1.55%. Currently, REPIX is an “AAS Recommended Neutral.” The Rydex Precious Metals Fund (RYPMX) was our highest rated within the “Rydex Mutual Fund” group. This mutual fund was last upgraded from an “AAS Recommended Neutral” to an “AAS Recommended Buy” on August 2, 2006 when the closing price was 55.59. As of Friday, August 11th, RYPMX closed at 53.12 for a loss of 4.66%. Currently, RYPMX remains an “AAS Recommended Buy.”

The Rydex Precious Metals Fund (RYPMX) was our highest rated within the “Rydex Mutual Fund” group. This mutual fund was last upgraded from an “AAS Recommended Neutral” to an “AAS Recommended Buy” on August 2, 2006 when the closing price was 55.59. As of Friday, August 11th, RYPMX closed at 53.12 for a loss of 4.66%. Currently, RYPMX remains an “AAS Recommended Buy.”

0 Comments:

Post a Comment

<< Home