AAS Top Ten as of August 18, 2006

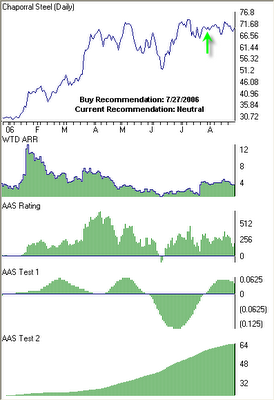

The graphs below represent the top holding within each of the six groups as of Friday, August 18, 2006. The green arrow represents the first date that the security became an “AAS Recommended Buy” after previously being an “AAS Recommended Sell.” I’ve also included the most recent recommendation of each security.

With such a bland week of trading on low volume and little economic stimulus, it’s no wonder that only four of the six AAS Top Ten securities are gainers. This week the three mutual funds took the spotlight, especially the Fidelity Select Software & Computer fund. I’m actually surprised by the relative weakness in the iShares S&P Latin American 40 Fund, losing over 1% since the initial “buy” recommendation. I suspect this is more due to profit taking than fundamental or technical weakness. And although I’m still favorable towards international markets, I’d keep a close watch on any international funds owned for further deterioration.

Chaparral Steel Company (CHAP) was our highest rated stock within the “Long Stock” group as of August 18, 2006. This marks the second time in three weeks where CHAP was the highest rated stock based on the AAS rating score. I noted in an earlier post that CHAP has been the victim of the elevated volatility the markets have dealt with over the last few weeks. The graph below further illustrates the trading-range that CHAP has been trapped in since mid-July. Our analysis produced a “buy” recommendation on July 27, 2006 when the closing price was 69.88. As of Friday, August 25th, CHAP closed at 69.72 for a loss of -0.22% since the initial “buy” recommendation. Currently, the stock carries a “neutral” recommendation meaning “hold.”

NVR, Inc. (NVR) was again our weakest stock within the “Short-Sell Stock” group. NVR was upgraded on April 25, 2006 to a “buy” recommended security, but then almost immediately reverted to a “sell” recommended security two days later when the closing price was 763.00. As of August 25th, NVR closed at 493.00 for a gain of 35.38% since the initial “short-sale” recommendation. Shorting stocks, although profitable if done correctly, is risky business. There's no need to do it unless you have the experience, knowledge, and capital to cover your short if needed. QMA does not short stocks for its clients and AAS does not recommend the practice to its subscribers.

NVR, Inc. (NVR) was again our weakest stock within the “Short-Sell Stock” group. NVR was upgraded on April 25, 2006 to a “buy” recommended security, but then almost immediately reverted to a “sell” recommended security two days later when the closing price was 763.00. As of August 25th, NVR closed at 493.00 for a gain of 35.38% since the initial “short-sale” recommendation. Shorting stocks, although profitable if done correctly, is risky business. There's no need to do it unless you have the experience, knowledge, and capital to cover your short if needed. QMA does not short stocks for its clients and AAS does not recommend the practice to its subscribers. The iShares S&P Latin America 40 Index ETF (ILF) was our highest rated within the “Exchange Traded Fund” group. It was last up-graded to an "AAS Recommended Buy" on August 2, 2006 when the closing price was 140.09. We began to notice a strengthening in the international markets in late-July and I wrote about it in my August 10th post. Unfortunately, ILF has also experienced significant levels of volatility over the last few weeks, eventually culminating in a “sell” recommendation on August 23rd and had a closing price of 138.24 on August 25th. Despite the modest -1.32% loss since the initial “buy” recommendation, I still believe that international markets should be utilized, at least until the domestic markets solidify and establish either a bullish or bearish bias.

The iShares S&P Latin America 40 Index ETF (ILF) was our highest rated within the “Exchange Traded Fund” group. It was last up-graded to an "AAS Recommended Buy" on August 2, 2006 when the closing price was 140.09. We began to notice a strengthening in the international markets in late-July and I wrote about it in my August 10th post. Unfortunately, ILF has also experienced significant levels of volatility over the last few weeks, eventually culminating in a “sell” recommendation on August 23rd and had a closing price of 138.24 on August 25th. Despite the modest -1.32% loss since the initial “buy” recommendation, I still believe that international markets should be utilized, at least until the domestic markets solidify and establish either a bullish or bearish bias. The Fidelity Select Software & Computer Fund (FSCSX) was our highest rated within the “Fidelity Select Mutual Fund” group. The fund normally invests 80% of assets in companies that design, produce or distribute software products. And although the software sector, as represented by IGV, lost over 1.80% last week, it’s up nearly 7.50% over the last month and remains an AAS Recommended “Buy” sector. FSCSX was last upgraded to an “AAS Recommended Buy” on July 27, 2006 when the closing price was 54.24. As of Friday, August 25th, FSCSX closed at 56.81 for a gain of 4.74% since the initial investment. Currently, FSCSX remains an “AAS Recommended Buy.”

The Fidelity Select Software & Computer Fund (FSCSX) was our highest rated within the “Fidelity Select Mutual Fund” group. The fund normally invests 80% of assets in companies that design, produce or distribute software products. And although the software sector, as represented by IGV, lost over 1.80% last week, it’s up nearly 7.50% over the last month and remains an AAS Recommended “Buy” sector. FSCSX was last upgraded to an “AAS Recommended Buy” on July 27, 2006 when the closing price was 54.24. As of Friday, August 25th, FSCSX closed at 56.81 for a gain of 4.74% since the initial investment. Currently, FSCSX remains an “AAS Recommended Buy.” The ProFunds Ultra Japan Fund (UJPIX) was our highest rated within the “ProFund Mutual Fund” group for the second week in a row. Similar to our ETF analysis, we saw increased alpha-generation among international markets beginning several weeks ago, with Large-Cap Japan funds the highest among both ProFunds and Rydex. This fund, which is leveraged to correspond to 200% of the daily performance of the Nikkei 225 Stock Average, was last upgraded to an “AAS Recommended Buy” on August 9, 2006 when the closing price was 59.61. As of Friday, August 25th, UJPIX closed at 62.99 for a gain of 5.67%. Currently, UJPIX is an “AAS Recommended Buy.”

The ProFunds Ultra Japan Fund (UJPIX) was our highest rated within the “ProFund Mutual Fund” group for the second week in a row. Similar to our ETF analysis, we saw increased alpha-generation among international markets beginning several weeks ago, with Large-Cap Japan funds the highest among both ProFunds and Rydex. This fund, which is leveraged to correspond to 200% of the daily performance of the Nikkei 225 Stock Average, was last upgraded to an “AAS Recommended Buy” on August 9, 2006 when the closing price was 59.61. As of Friday, August 25th, UJPIX closed at 62.99 for a gain of 5.67%. Currently, UJPIX is an “AAS Recommended Buy.” The Rydex Japan Advantage Fund (RYJPX) was our highest rated within the “Rydex Mutual Fund” group on August 18th. This mutual fund was last upgraded from an “AAS Recommended Neutral” to an “AAS Recommended Buy” on August 9, 2006 when the closing price was 37.51. As of Friday, August 25th, RYJPX closed at 38.13 for a gain of 1.65%. Unbeknownst to many mutual fund investors, RYJPX is designed to seek investment results that correlate to the daily price movement of the Topix 100 Index, as opposed to the Nikkei 225 like its counterpart at ProFunds. RYJPX uses sophisticated investments such as futures, options and equity swap agreements to apply leverage to the fund and increase exposure to 125% of the underlying index. Currently, RYJPX is an “AAS Recommended Neutral.”

The Rydex Japan Advantage Fund (RYJPX) was our highest rated within the “Rydex Mutual Fund” group on August 18th. This mutual fund was last upgraded from an “AAS Recommended Neutral” to an “AAS Recommended Buy” on August 9, 2006 when the closing price was 37.51. As of Friday, August 25th, RYJPX closed at 38.13 for a gain of 1.65%. Unbeknownst to many mutual fund investors, RYJPX is designed to seek investment results that correlate to the daily price movement of the Topix 100 Index, as opposed to the Nikkei 225 like its counterpart at ProFunds. RYJPX uses sophisticated investments such as futures, options and equity swap agreements to apply leverage to the fund and increase exposure to 125% of the underlying index. Currently, RYJPX is an “AAS Recommended Neutral.”

0 Comments:

Post a Comment

<< Home