AAS Top Ten as of July 28, 2006

The graphs below represent the top holding within each of the six groups as of Friday, July 28, 2006. I’ve included the date that the equity was most recently labeled an “AAS Recommended Buy,” or in the case of the short-sell group, an “AAS Recommended Sell.” I’ve also included the most recent recommendation of each security. The purpose of posting these graphs is to illustrate both the power of our proprietary alpha analytic and also how average investors can use it to generate alpha for their own investment portfolios.

Reynolds American Inc. (RAI) was our highest rated stock within the “Long Stock” group as of July 28, 2006. This non-cyclical tobacco manufacturing company was last upgraded from an “AAS Recommended Neutral” to an “AAS Recommended Buy” on June 15, 2006 when the closing price was 111.15 and the AAS Rating Score was 58.92. As of Friday, August 4th, RAI closed at 124.90 for a gain of 12.37% since the upgrade in mid-June. Currently, RAI remains an "AAS Recommended Buy" with an AAS Rating Score of 94.37.

Carpenter Technology Corp. (CRS) was our lowest rated stock within the “Short-Sell Stock” group as of July 28, 2006. This company, which manufactures, fabricates and distributes specialty metals and engineering products, last shifted from a "recommended neutral” to a "recommended sell” on July 26, 2006 when the closing price was 90.67 and the rating score was -378.72. As of Friday, August 4th, CRS closed at 97.90 gaining 7.97% since becomming a "recommended sell." Currently, CRS remains a "recommended sell" with a rating score of -213.50. Shorting stocks, although profitable if done correctly, is risky business. There's no need to do it unless you have the experience, knowledge, and capital to cover your short if needed. QMA does not short stocks for its clients and AAS does not recommend the practice to its subscribers.

Carpenter Technology Corp. (CRS) was our lowest rated stock within the “Short-Sell Stock” group as of July 28, 2006. This company, which manufactures, fabricates and distributes specialty metals and engineering products, last shifted from a "recommended neutral” to a "recommended sell” on July 26, 2006 when the closing price was 90.67 and the rating score was -378.72. As of Friday, August 4th, CRS closed at 97.90 gaining 7.97% since becomming a "recommended sell." Currently, CRS remains a "recommended sell" with a rating score of -213.50. Shorting stocks, although profitable if done correctly, is risky business. There's no need to do it unless you have the experience, knowledge, and capital to cover your short if needed. QMA does not short stocks for its clients and AAS does not recommend the practice to its subscribers. The iShares Cohen and Steers Realty Majors ETF (ICF) was our highest rated within the “Exchange Traded Fund” group for the third week in a row. It was last up-graded from a "recommended neutral” to a "recommended buy" on June 29, 2006 when the closing price was 82.96 and the rating score was 8.97. As of Friday, August 4th, ICF closed at 89.27 for a gain of 7.61% since the late-June investment. Currently, ICF remains a "recommended buy" with a rating score of 29.84.

The iShares Cohen and Steers Realty Majors ETF (ICF) was our highest rated within the “Exchange Traded Fund” group for the third week in a row. It was last up-graded from a "recommended neutral” to a "recommended buy" on June 29, 2006 when the closing price was 82.96 and the rating score was 8.97. As of Friday, August 4th, ICF closed at 89.27 for a gain of 7.61% since the late-June investment. Currently, ICF remains a "recommended buy" with a rating score of 29.84. The Fidelity Select Healthcare Fund (FSPHX) was our highest rated within the “Fidelity Select Mutual Fund” group for the second week in a row. It was last upgraded from a "recommended neutral” to a “recommended buy” on July 20, 2006 when the closing price was 119.32 and the rating score was 0.32. As of Friday, August 4th, FSPHX closed at 122.90 for a gain of 3.00%. Currently, FSPHX remains a “recommended buy" with a rating score of 0.81.

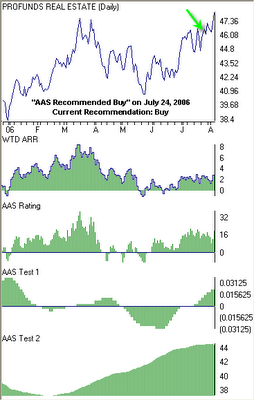

The Fidelity Select Healthcare Fund (FSPHX) was our highest rated within the “Fidelity Select Mutual Fund” group for the second week in a row. It was last upgraded from a "recommended neutral” to a “recommended buy” on July 20, 2006 when the closing price was 119.32 and the rating score was 0.32. As of Friday, August 4th, FSPHX closed at 122.90 for a gain of 3.00%. Currently, FSPHX remains a “recommended buy" with a rating score of 0.81. The ProFunds Ultra Real Estate Investment Fund (REPIX) was our highest rated within the “ProFund Mutual Fund” group for the week ending July 28, 2006. This fund is leveraged to correspond to 150% of the daily performance of the Dow Jones U.S. Real Estate Index. This mutual fund was last upgraded from a "recommended neutral” to a "recommended buy” on July 24, 2006 when the closing price was 45.84 and the rating score was 15.7. As of Friday, August 4th, REPIX closed at 48.07 for a gain of 4.86%. Currently, REPIX remains a "recommended buy” with a rating score of 20.38.

The ProFunds Ultra Real Estate Investment Fund (REPIX) was our highest rated within the “ProFund Mutual Fund” group for the week ending July 28, 2006. This fund is leveraged to correspond to 150% of the daily performance of the Dow Jones U.S. Real Estate Index. This mutual fund was last upgraded from a "recommended neutral” to a "recommended buy” on July 24, 2006 when the closing price was 45.84 and the rating score was 15.7. As of Friday, August 4th, REPIX closed at 48.07 for a gain of 4.86%. Currently, REPIX remains a "recommended buy” with a rating score of 20.38. The Rydex Real Estate Fund (RYHRX) was our highest rated within the “Rydex Mutual Fund” group for the week ending July 28, 2006. This mutual fund was last upgraded from a “recommended neutral” to a “recommended buy” on July 24, 2006 when the closing price was 35.80 and the rating score was 5.76. As of Friday, August 4th, RYHRX closed at 37.10 for a gain of 3.63%. Currently, RYHRX remains a “recommended buy” with a rating score of 7.61.

The Rydex Real Estate Fund (RYHRX) was our highest rated within the “Rydex Mutual Fund” group for the week ending July 28, 2006. This mutual fund was last upgraded from a “recommended neutral” to a “recommended buy” on July 24, 2006 when the closing price was 35.80 and the rating score was 5.76. As of Friday, August 4th, RYHRX closed at 37.10 for a gain of 3.63%. Currently, RYHRX remains a “recommended buy” with a rating score of 7.61.

0 Comments:

Post a Comment

<< Home