AAS Top Ten: July 14, 2006

Volt Information Service (VOL) was the highest rated stock as of July 14th. This company shifted from a "Neutral" rating to an "AAS Recommended Buy" on April 20, 2006. Since VOL became an "AAS Recommended Buy," is has gone up nearly 40% as of the close on July 21st. Currently, VOL is an "AAS Recommended Neutral," which basically means "Hold." The technicals have weakened somewhat over the last few days, but they have not deteriorated to the point where a Sell recommendation is justified.

The lowest rated stock on July 14th was NVR, Inc. (NVR). The "Short Stock" group included in the AAS Top Ten page is comprised of those securities that are "AAS Recommended Sells" that have the lowest AAS Rating Scores. We published an "AAS Recommended Sell" of NVR on April 27, 2006. As of July 14th, the AAS Rating Score was -2599.62. From the initial "AAS Sell Recommendation" through the close on July 21st, NVR was down -44%. Currently, NVR is still an "AAS Recommended Sell." Shorting stocks, although profitable if done correctly, is risky business. There's no need to do it unless you have the experience, knowledge, and capital to cover your short if needed. QMA does not short stocks for its clients and AAS does not recommend the practice to its subscribers.

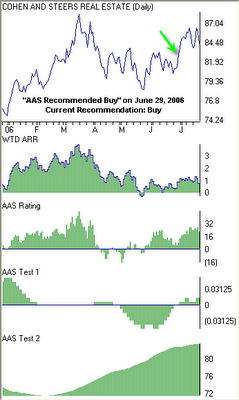

The iShares Cohen and Steers Realty Majors ETF (ICF) was the highest rated Exchange Traded Fund on July 14th with an AAS Rating Score of 24.37. ICF was up-graded to an "AAS Recommended Buy" on June 29, 2006. Since then, ICF has seen a modest 1.64% price increase. Currently, ICF remains an "AAS Recommended Buy."

The iShares Cohen and Steers Realty Majors ETF (ICF) was the highest rated Exchange Traded Fund on July 14th with an AAS Rating Score of 24.37. ICF was up-graded to an "AAS Recommended Buy" on June 29, 2006. Since then, ICF has seen a modest 1.64% price increase. Currently, ICF remains an "AAS Recommended Buy." Real Estate, along with Utilities, and more recently Healthcare, have been the only sectors rated "AAS Recommended Buy." That's why it was no suprise that the Fidelity Real Estate Investment Fund (FRESX) was the highest rated Fidelity Select mutual fund as of July 14th. This ETF was also upgraded to an "AAS Recommended Buy" on June 29, 2006. Since then, FRESX has gone up by 0.23% and is an "AAS Recommended Neutral" equity.

Real Estate, along with Utilities, and more recently Healthcare, have been the only sectors rated "AAS Recommended Buy." That's why it was no suprise that the Fidelity Real Estate Investment Fund (FRESX) was the highest rated Fidelity Select mutual fund as of July 14th. This ETF was also upgraded to an "AAS Recommended Buy" on June 29, 2006. Since then, FRESX has gone up by 0.23% and is an "AAS Recommended Neutral" equity. The ProFunds Ultra Short OTC Fund (USPIX) was the highest rated ProFund mutual fund on July 14th with an AAS Rating Score of 27.12. This fund is leveraged to correspond to twice the inverse of the NASDAQ 100 Index. In times of high volatility, tech stocks often under-perform, and this recent range-bound market is no exception. This fund was upgraded to an "AAS Recommended Buy" on July 5th when the price was 17.48. As of Friday, USPIX closed at 20.02 for a gain of 14.5% and currently remains an "AAS Recommended Buy."

The ProFunds Ultra Short OTC Fund (USPIX) was the highest rated ProFund mutual fund on July 14th with an AAS Rating Score of 27.12. This fund is leveraged to correspond to twice the inverse of the NASDAQ 100 Index. In times of high volatility, tech stocks often under-perform, and this recent range-bound market is no exception. This fund was upgraded to an "AAS Recommended Buy" on July 5th when the price was 17.48. As of Friday, USPIX closed at 20.02 for a gain of 14.5% and currently remains an "AAS Recommended Buy." Similar to above, the Rydex Inverse Dynamic OTC Fund (RYVNX) was the highest rated Rydex mutual fund on July 14th with an AAS Rating Score of 33.83. This fund was upgraded to an "AAS Recommended Buy" one day later than its ProFund counterpart. On July 6th the closing price of RYVNX was 22.19 and as of Friday, the close was 25.35 for a gain of over 14%. RYVNX is still an "AAS Recommended Buy."

Similar to above, the Rydex Inverse Dynamic OTC Fund (RYVNX) was the highest rated Rydex mutual fund on July 14th with an AAS Rating Score of 33.83. This fund was upgraded to an "AAS Recommended Buy" one day later than its ProFund counterpart. On July 6th the closing price of RYVNX was 22.19 and as of Friday, the close was 25.35 for a gain of over 14%. RYVNX is still an "AAS Recommended Buy."

0 Comments:

Post a Comment

<< Home